Currency Exchange Rate

Currency exchange rate - this is the value of one country's currency expressed in another country's currency unit at the time of buying and selling.

For example, by selling 1 US dollar today, you will get 2.63 GEL. Yesterday, the rate of lari was less than the dollar, tomorrow it will be a different rate. Everything depends on supply and demand. On the other hand, the National Bank has a special role and responsibility for the strength and reliability of the currency.

The national currency in Georgia has been the GEL since 1995. Apart from some exceptions, GEL is the only legal means of payment. Conditionally, a tourist coming from America will have to use Georgian lari to buy any item or product.

What is currency in general? A monetary unit used in a particular country is currency is called. It is a medium of exchange, which is usually given in the form of money and coins. When you buy bread or butter at the store with paper money or a credit card, you are using currency. There are more than 170 currencies in the world and they are issued by governments or central banks.

Until the beginning of the 20th century, the world lived in a multi-currency regime. Gold, copper and silver were used instead of money. Even today, there are several countries (China, Cuba, Ecuador) where there is still a multi-currency regime. In China, Renminbi is used locally, while Yuan is used for international transactions.

Fixed or Floating Exchange Rate

A floating exchange rate applies in Georgia. During this regime, the exchange rate is formed on the basis of market supply and demand and macroeconomic factors. Currencies are bought and sold in the foreign exchange market, and whichever currency has more demand, it gets stronger. Under such conditions, free capital mobility and inflation targeting are easier.

With a fixed exchange rate, the local currency is pegged to one or more currencies of another country. Earlier, currency was converted into gold at a predetermined parity and a fixed exchange rate was maintained on the gold standard. It should be noted that until 1997, the Georgian lari was pegged to the US dollar, because there was more confidence and a feeling of stability towards the newly created lari.

It is true that we have had a free floating exchange rate since 1997, but we should add a manageable one in the future. The National Bank has the opportunity to influence the exchange rate of the GEL through foreign exchange interventions and strengthen the GEL by selling dollars at the foreign exchange auction. For this, there are foreign exchange reserves.

National Bank exchange rate is published every day at 17:00, except for weekends. Before that, trading on the Bloomberg BMatch platform is carried out by the National Bank, commercial banks, microfinance organizations and the International Investment Fund.

Currency exchange rate is one of the most important factors that can have a great impact on a country's economy, financial stability and social welfare.

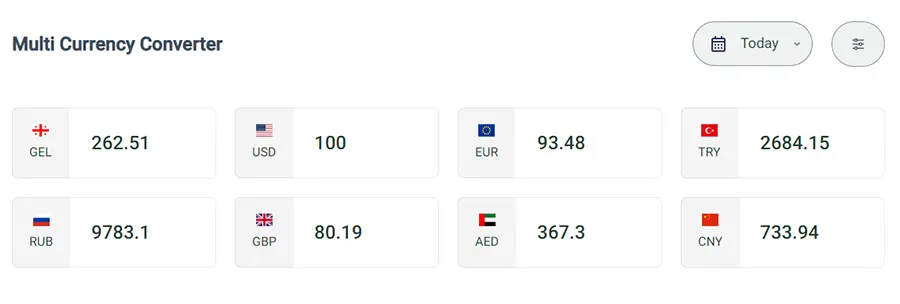

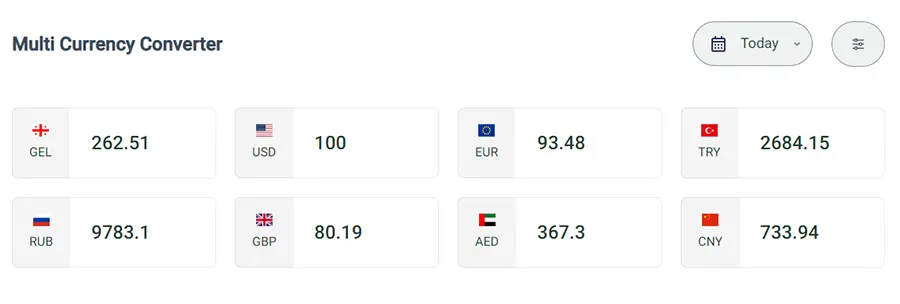

Exchange Rate - Myvaluta.ge

If you want to know the exchange rate, Myvaluta.ge is the platform where you can see the exchange rate of any foreign currency against the GEL at any time.

For example, you are interested in the dollar rate today. Log in to Myvaluta.ge and you will get fully updated information on how much the dollar exchange rate is in relation to the GEL.

The situation is exactly the same with the euro exchange rate. There is a lot of interest in what is the euro exchange rate in Georgia, and you will get a reliable and quick answer from us.

Turkey is one of the main economic partners of Georgia, and the lira-lari exchange rate is also in high demand.

In addition, there is a multi-converter function on the website and you can compare the rates of dollars, euros, lira and other currencies at the same time.

You can observe the dynamics of the last 7 days, how the GEL changed, which currency was strengthened and devalued.

Which currency rate do you want to check?

- Pound Sterling

- Azerbaijani manat

- Armenian dram

- Swiss Franc

- Bahrain dinar

- Ukrainian hryvnia

- And the currencies of more than 50 different countries are represented on Myvaluta.ge

Exchange Rate in Kiosks or Exchange Rate in Banks

Currency exchange in currency exchange offices or currency exchange booths is much more profitable than in commercial banks.

valutis kursi kiosks is cheap, which makes it more attractive for the population to exchange money at kiosks. And the demand of legal entities in banks determines what the rate will be. The difference often ranges from 2 to 7-8 whites. When it comes to a large amount, the difference is quite noticeable.

Instead, microfinance organizations offer highly favorable conditions to individuals or small businesses. If you are interested in the exchange rate in Rico - you already know where to look.

Myvaluta.ge differs from other sites in that here you can find out what the currency exchange rate is in banks and in kiosks.

The National Bank supervises the licensing and activity of currency exchange points. Read all the important information before the currency exchange operation or get it from the person working at the point. Get the receipt after payment. If you notice any suspicious situation, you can contact the National Bank, which is obliged to help you.

History, Mission and Exchange Rate of the National Bank

In 1919, during the First Republic, the first state bank was opened. The modern National Bank of Georgia was established in 1991 after the collapse of the Soviet Union.

The highest body is the board of the National Bank, which consists of 9 members and is headed by the president of the bank.

The mission of the National Bank is to promote the long-term growth of the country's economy. Also, price stability, ensuring the effective functioning of the financial sector, taking care of the strength of the GEL and trust in it. The bank's objectives include combating counterfeiting, regulating the circulation of cash, and supervising commercial banks and currency exchange offices.

In order to achieve price stability, it implements monetary policy with inflation targeting. The target rate of inflation should not exceed 3%.

That is why it is at his disposal to reduce or increase the refinancing rate. The refinancing rate is a limit set for commercial banks on loans issued.

The National Bank has international reserves for economic and financial stability. The reserve is mainly kept in foreign currency, although some countries also keep it in gold. As of today, the reserve of the National Bank of Georgia is at a historical maximum and amounts to more than 5 billion dollars.

Reserves are a kind of stability guarantee of the GEL. When the exchange rate is sharply devalued, the bank will supply dollars to the foreign exchange market through intervention and will try to strengthen the GEL. Strengthened lari is one of the main keys to reducing inflation.

Where and How Does Foreign Currency Come Into Georgia?

The exchange rate change is influenced by 3 factors in particular.

- Foreign direct investments

- Money transfers from abroad

- Revenues from tourism

The more US dollars enter the market, the more its price in GEL will decrease.

In 2022, according to the data of the National Statistics Service, foreign direct investment of more than 2 billion dollars entered. This figure was 800 million more than the figure of 2021.

The largest investments (437 million) were from the United Kingdom. The second was Spain (360), and the third was the Netherlands (196). It is interesting that, according to the sectors, financial and insurance activities were the most affected.

In the first quarter of 2023, 566 million dollars were invested in the economy of Georgia. 10 million more than in the first quarter of 2022.

In 2022, remittances of 4.4 billion dollars were transferred to Georgia from abroad, which is 2.1 billion more than the data of 2021.

2 billion left Russia due to active migration from Russia. There was an increase from Italy (432), USA (327) and Germany (164).

The strengthening of the lari was attributed to the increased foreign remittances, which allowed the National Bank to significantly increase its foreign exchange reserves.

In 2023, remittances from Russia decreased, as a result, the national currency caused certain fluctuations.

In 2022, international visitors spent 3.5 billion dollars in Georgia. This is 182% more than in 2021. According to months, the highest income was recorded in August (523).

If all these three factors are in order, it can be said that the exchange rate of lari will always be very stable.

It is also implied that when a country depends on remittances from abroad, it indicates that the active labor force is abroad.

On the other hand, the pandemic showed that the state cannot depend only on tourism. During the pandemic, Lari was one of the most devalued currencies and 1 dollar was worth more than 3.6 GEL.

Besides these components, currency devaluation may be caused by economic crisis, international and domestic political problems, devaluation of currencies of trading partners and other reasons.

Exchange Rate - Inflation, Deflation and Devaluation

When we talk about the exchange rate, it is important to consider inflation, deflation, devaluation and their types.

Inflation means an increase in the general level of prices for goods and services. In other words, it is also called a decrease in the purchasing power of money.

Inflation is a different phenomenon from inflation. Devaluation means reducing the exchange rate of the national currency against foreign currencies.

There are several types of inflation, among which the most severe is hyperinflation. Hyperinflation means a colossal price increase of at least 40-50%. The national currency becomes completely ineffective. A similar thing was observed in Georgia in the 90s, when the temporarily introduced coupon experienced a 678% devaluation. 1 million coupons in 1995 was equal to 1 GEL. Russian ruble and American dollar were actively used by the population.

The anti-inflation process is deflation. During deflation, the level of prices for goods and services generally decreases and becomes cheaper.

It is a bit difficult to imagine, but in June 2006, 0.2% deflation was registered in Georgia. At that time, the reason for deflation was the reduction of excise duty. It is interesting that in 2006, the National Bank prevented the strengthening of the lari for a certain period of time.

In general, moderate inflation is commonplace, and for a country like Georgia, 3 to 5% inflation is even considered a positive thing. Moderate inflation helps the growth of real gross domestic product (GDP) and has little negative impact on the exchange rate.

Digital Gel and Cryptocurrency

The National Bank has been working on the introduction of digital currency, digital lari, for several years. The main idea of digital lari is to simplify financial transactions and to ease the financial system consisting of many intermediaries.

We can also call digital GEL "crypto-lari", because its content, when it takes its final form, will resemble cryptocurrency. When you make any transaction, for example, you pay a utility bill, the paying organization incurs a fee. With the help of blockchain technology, transfers are cheaper. The exchange rate will usually be tied to the national GEL.

In addition, to some extent digital GEL will be able to have a positive impact on reducing inflation.

Currencies issued by governments or central banks are called fiat or fiat currencies. In contrast, crypto is a decentralized digital currency.

What is Bitcoin? Bitcoin is the most successful cryptocurrency and electronic payment method that is completely independent from the control of governments or banks. It works according to the P2P (peer-to-peer) principle, which excludes the involvement of a third person between two parties. Uses blockchain technology as a ledger of transactions. Blockchain is a chain of blocks that make up a database and are managed by each user of the network.

On Myvaluta.ge you can find out the cryptocurrency rate.

- Bitcoin

- Etherium

- Dodgecoin

- Solana

- You will find Shiba Coin and more than 100 other cryptocurrencies.

Also, the volume and market cap of the coin and how much the value has increased or decreased in the last 24 hours.

There is still a lot of mistrust of cryptocurrency, but almost everyone agrees that it is the money of the future, and over time it will become even more popular and popular to use in everyday life.

Exchange Rate Today in Georgia

Many people wonder where the highest exchange rate is or how much 1 euro is worth. Of course, everyone wants to exchange money at the best rate and find out where such a place is.

With a lot of inaccurate and false information on the Internet, it is difficult to find a reliable platform that is constantly updated and has a professional team working on it.

Myvaluta.ge is a website where you can find all the information related to the exchange rate in one place. You can take a look at our website and see for yourself.

With the work of our experienced team, the update happens exactly every minute and provides you with correct, reliable and accurate data.

Most importantly, the site is very practical to use for each user.

Accordingly, the exchange rate - on Myvaluta.ge.

TBC Bank

TBC Bank

Bank of Georgia

Bank of Georgia

Liberty Bank

Liberty Bank

Valuto

Valuto

Rico Group

Rico Group

INTELIEXPRESS

INTELIEXPRESS

Crystal

Crystal

Giro Credit

Giro Credit

Fin Credit

Fin Credit